Professional

About Us

Our main objective is to provide a comprehensive legal service as well as offering security and guarantee the investments of the client in the Canary island territory.

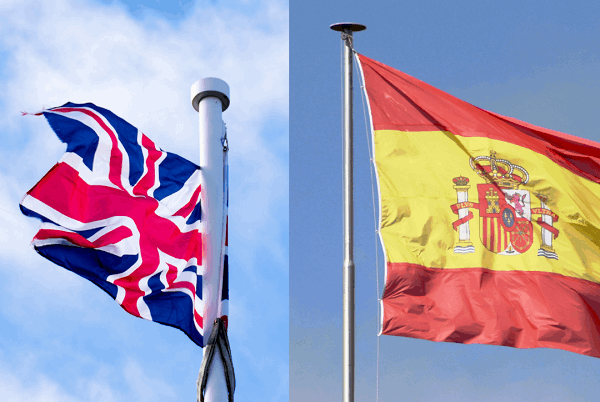

To ensure English clients interests, we are well versed in Spanish law, and on the other hand, we can rely on a solid network of legal partners knowledgeable in English law.

You should be aware that as a result of Brexit, the consequences for UK nationals are decisive if you have assets or property in Spain, as well as if you wish to invest in Spain.

A pragmatic approach in accordance with national legislation will provide confidence and security for assets held abroad. At TENERIFE WILLS Solicitors, English speaking lawyers based in Tenerife,

Follow Us: